Financial markets are always changing, and knowing about these changes is key for investors. Next year could see big shifts as central banks look to ease up on rules. Experts are watching these changes closely, as they could change how we invest in different areas.

Big financial groups are sharing their dovish policy predictions for the next year. They think central banks might switch from strict rules to more flexible ones. The Federal Reserve, European Central Bank, and Bank of England might change their ways due to new economic facts.

So, what does this mean for your money? A softer monetary policy can affect stocks, bonds, and real estate in different ways. Knowing this now helps investors get ready. We’re looking at different scenarios based on economic forecast 2025 data from top analysts and groups.

The Current Economic Landscape

The economy in 2024 is in a big change. Central banks are adjusting their ways because of new inflation and growth data. After fighting inflation with tight money, we’re seeing a shift that could change markets and growth a lot.

This shift brings both challenges and chances for investors, businesses, and people. They’re all trying to figure out what’s next in the uncertain economic world.

Key Economic Indicators in 2024

The economic signs in 2024 show a complex picture. Inflation has dropped a lot from its high points after the pandemic. Most big economies’ core inflation is close to the 2% target of central banks.

GDP growth is steady, with the U.S. growing at about 2.1% a year. Despite high interest rates, jobs are still plentiful, with low unemployment in many places.

People are buying more carefully now, with higher interest rates and inflation affecting their spending. Companies are investing cautiously, balancing growth plans with the cost of borrowing.

| Economic Indicator | 2023 Value | 2024 Current | 2024 Trend |

|---|---|---|---|

| Core Inflation Rate | 3.9% | 2.8% | Decreasing |

| GDP Growth | 2.5% | 2.1% | Stabilizing |

| Unemployment Rate | 3.7% | 3.9% | Slight Increase |

| Consumer Spending Growth | 2.8% | 1.9% | Moderating |

Transition from Hawkish to Dovish Policies

The move from hawkish to dovish policies started early in 2024. Central banks saw they’d made good progress against inflation. The Federal Reserve hinted at this change, talking about “balanced risks” instead of just inflation.

Some countries have already cut interest rates, calling these moves “recalibrations,” not a big easing. This careful step shows the tricky balance policymakers face. They want to help the economy grow but also keep inflation in check.

Markets quickly adjusted to the idea of easier money, with bond yields falling and stocks rising. But central bankers have warned against getting too excited. They say they’ll keep watching the data closely.

The current policy is cautiously dovish. Policymakers are open to helping the economy but still watching inflation closely. This period is setting the stage for a more dovish 2025, many analysts think.

Understanding Monetary Policy Doves

It’s key to know about monetary policy doves to guess what will happen in the financial markets in 2025 and later. Central banks face big challenges in getting the economy back on track. The difference between dovish and hawkish policies is very important for investors and the market.

This section will look into what dovish monetary policy is and how it has affected markets in the past.

Definition and Characteristics of Dovish Policymakers

Monetary policy doves focus on economic growth and jobs more than keeping prices low. They use lower interest rates and more money in the economy to help during tough times.

Dovish policymakers are easy to spot. They worry more about jobs and are okay with a little inflation. They usually vote for policies that help the economy grow, not ones that slow it down.

These policymakers believe that a strong economy and jobs are more important than a little inflation. This is different from hawkish policymakers, who worry more about keeping prices stable.

| Characteristic | Dovish Policymakers | Hawkish Policymakers |

|---|---|---|

| Primary Concern | Unemployment/Growth | Inflation Control |

| Interest Rate Preference | Lower Rates | Higher Rates |

| Policy Approach | Accommodative | Restrictive |

| Risk Tolerance | Higher Inflation Acceptable | Inflation Aversion |

Historical Impact of Dovish Policies on Markets

Dovish policies have shaped markets in the past. When central banks are dovish, markets get more liquid, borrowing costs drop, and investors take more risks.

This leads to higher prices for assets like stocks, real estate, and bonds. As these assets grow in value, people spend more and businesses invest more, boosting the economy.

But, long-term dovish policies can cause problems. Low interest rates for too long can lead to risky behavior, inflate asset prices, and create financial instability in the future.

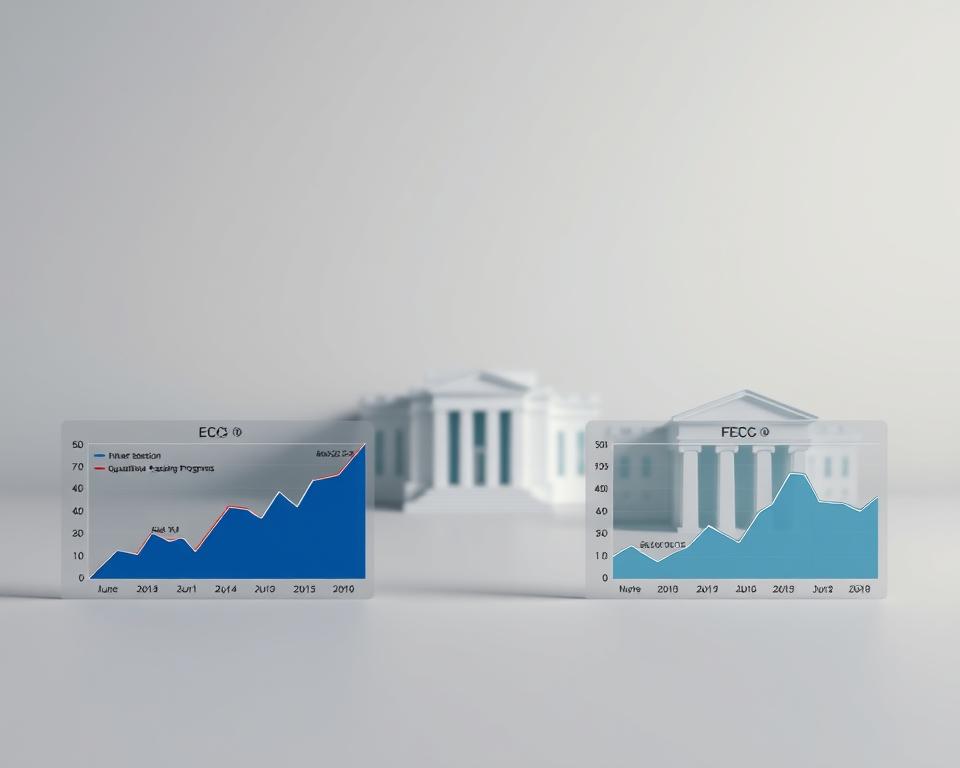

Case Study: 2008-2015 Dovish Era

The 2008 crisis led to a big dovish move by the Federal Reserve. Chairman Ben Bernanke cut rates to almost zero and started buying lots of assets. This dovish time saw the S&P 500 go up about 150% from 2009 to 2015, with inflation staying under 2% most of the time.

The housing market started to get better, companies borrowed more, and unemployment fell from 10% to under 5% during this period.

Case Study: Post-Pandemic Monetary Response

The COVID-19 pandemic made central banks even more dovish. The Federal Reserve set rates to zero and bought over $120 billion in assets each month. This big move helped markets bounce back quickly from the March 2020 crash.

But, this dovish action, unlike after 2008, came with supply chain issues and big government spending. This led to inflation hitting 40-year highs by 2022. This shows how dovish policies can work differently with other economic factors.

The Federal Reserve’s Shifting Stance

The Federal Reserve is changing in ways that could change how it handles money by 2025. As the world’s top central bank, these changes will affect markets, investments, and growth. We need to understand these shifts by looking at the Federal Open Market Committee (FOMC).

Current Fed Composition and Policy Leanings

The Fed has a mix of dovish and hawkish members. Chair Jerome Powell is leaning dovish, wanting to cut rates if inflation goes down. The FOMC is slowly moving towards focusing on jobs and growth over inflation.

Fed dovish memberslike Governors Lisa Cook and Christopher Waller want to ease policy when the economy allows. On the other hand, hawkish members like Michelle Bowman and Neel Kashkari are worried about inflation. But their influence is decreasing in recent talks.

| FOMC Member | Policy Leaning | Key Position | Voting Status |

|---|---|---|---|

| Jerome Powell | Moderate/Increasingly Dovish | Chair | Permanent Voter |

| Lisa Cook | Dovish | Governor | Permanent Voter |

| Michelle Bowman | Hawkish | Governor | Permanent Voter |

| Austan Goolsbee | Dovish | Chicago Fed President | Rotating Voter |

| Neel Kashkari | Hawkish | Minneapolis Fed President | Rotating Voter |

Anticipated Changes in Fed Leadership by 2025

By 2025, the Fed will see big changes in leadership, possibly making it even more dovish. Chair Powell’s term ends in May 2026, and there’s already talk about his successor. The leading candidates are dovish economists close to the current administration.

By 2025, several regional Fed presidents will retire, opening spots for new, dovish members. The New York Fed, with its permanent vote, might also see a change. This could greatly influence policy.

The Board of Governors has one empty seat, with more likely to open up as terms end or members leave. Who gets these jobs will shape the Fed’s policies for the rest of the decade.

Potential Impact on Interest Rate Decisions

These changes suggest the Fed will set interest rates more loosely by 2025. Experts think the Fed will cut rates several times, possibly making them under 3% by mid-2025 if inflation stays low.

The rate of these cuts will depend on the economy. But a dovish Fed will likely focus on keeping jobs strong rather than fighting inflation too early. This is a big change from the Fed’s hikes in 2022-2023.

Markets are already expecting these dovish moves, with futures showing at least four rate cuts by 2025. But the Fed’s actual moves will depend on the economy and who’s on the committee as leadership changes happen.

Doves Chart 2025: Key Predictions

The doves chart 2025 analysis shows a big change in central bank plans for the next year. After fighting inflation with tight money policies, banks are now leaning towards easier money. This big shift will affect markets and economies worldwide.

Our study combines forecasts from top economists, market signs, and bank talks. It outlines possible changes in money policy. Yet, there’s still a lot of debate on how fast and how much these changes will be.

Interest Rate Trajectories

Interest rates are key in any money policy forecast. For 2025, interest rate forecasts point to rates going down in big economies. But, how fast they’ll drop is up for grabs among experts.

Big banks like the Federal Reserve, European Central Bank, and Bank of England will adjust rates based on their own economic situations. Rate cuts will depend on inflation, jobs, and overall growth.

Moderate Dovish Scenario

In the moderate dovish scenario, banks cut rates slowly. The Federal Reserve might lower rates by 0.25-0.5 points several times in 2025. This could bring the federal funds rate to 3.5-3.75% by the end of the year.

The ECB might also cut rates to about 2.25%. The Bank of England could aim for 3.0%. This cautious plan assumes inflation keeps falling and the economy grows but slowly. Banks will stay ready to adjust if inflation rises again.

Aggressive Dovish Scenario

The aggressive dovish scenario sees bigger economic problems needing bold action. The Federal Reserve might cut rates by 0.5-1 point more times, aiming for 2.5-2.75% by year-end.

Similarly, the ECB could drop rates to 1.5% or less. The Bank of England might target 2.25%. This scenario kicks in if the economy shows big drops in jobs, spending, or investment, and inflation falls too low.

Quantitative Easing Possibilities

Next to rate changes, quantitative easing forecast models hint at central banks buying more assets in 2025. These tools were used after the 2008 crisis and again during the pandemic.

The Federal Reserve is most likely to start QE again if the economy worsens. Our analysis shows a 40% chance of new QE starting in the second half of 2025. It could buy $50-75 billion a month in Treasuries and mortgage-backed securities.

The ECB faces unique challenges with QE due to different economic states in member countries. Still, a €30-40 billion monthly asset purchase program could be an option if inflation drops a lot and growth slows.

Future QE programs might focus more on green projects and infrastructure. This would help meet economic goals while providing needed stimulus.

The success of QE will depend on working well with fiscal policy and rules. Central banks are now seeing the importance of these connections. They plan to manage the economy more holistically in the future.

Comparing Major Financial Institutions’ Dovish Outlooks

Big financial names have different views on the Federal Reserve’s plans for 2025. They offer a guide on what to expect. Their forecasts shape market hopes and investment plans. Knowing their differences helps investors understand the changing money scene.

Goldman Sachs vs. JP Morgan Predictions

Goldman Sachs thinks the Fed will be more dovish than JP Morgan does. Goldman predicts three to four rate cuts by mid-2025. They believe core PCE inflation will drop to 2.1% by Q4 2025, allowing rates to fall to 3.25-3.50%.

“We expect the Fed to prioritize supporting employment over fighting phantom inflation risks,” notes Goldman’s chief economist in their latest economic outlook.

On the other hand, JP Morgan is more cautious. They forecast only two rate cuts by 2025, with rates around 3.75-4.00%. JP Morgan points out wage growth and strong consumer spending as reasons for inflation staying above target. This limits the Fed’s rate-cutting power.

The main difference is in inflation expectations. Goldman sees prices falling steadily, while JP Morgan thinks prices will be harder to bring down, needing a more careful policy.

Morgan Stanley vs. Bank of America Forecasts

Morgan Stanley predicts the most dovish scenario. They think the Fed will cut rates by five quarter-points by end-2025, to 2.75-3.00%. Morgan Stanley’s economists point to demographic changes, AI’s impact on productivity, and global price drops as reasons for this.

“Our models indicate a significant probability of inflation undershooting the Fed’s target by Q3 2025,” states Morgan Stanley’s latest monetary policy report.

Bank of America’s forecast is more moderate. They predict three to four rate cuts by 2025, with rates at 3.25-3.50% by year-end. Bank of America believes the Fed will act based on data and suggests cuts will be slow and measured. The timing of cuts is another area of difference. Morgan Stanley expects cuts to start sooner and keep coming, while Bank of America thinks most cuts will happen in the second half of 2025.

| Institution | Rate Cuts Forecast (2025) | Terminal Rate Range | Core Inflation Projection | Key Rationale |

|---|---|---|---|---|

| Goldman Sachs | 3-4 cuts | 3.25-3.50% | 2.1% | Structural disinflation, labor cooling |

| JP Morgan | 2 cuts | 3.75-4.00% | 2.4% | Persistent wage pressures, consumer resilience |

| Morgan Stanley | 5 cuts | 2.75-3.00% | 1.8% | AI productivity gains, global disinflation |

| Bank of America | 3-4 cuts | 3.25-3.50% | 2.2% | Data-dependent approach, gradual normalization |

Academic Economists’ Perspectives on 2025

Academic economists add important insights to our understanding of 2025’s economic scene. They explore the core economic principles that guide monetary decisions. This helps us see how central banks might tackle future economic hurdles.

Keynesian vs. Monetarist Dovish Predictions

The Keynesian dovish outlook suggests aggressive monetary easing during slowdowns. Keynesian economists push for lower interest rates and more government spending to boost demand. For 2025, they expect continued easy money policies to support jobs, even if it means a bit of inflation.

On the other hand, monetarist policy predictions focus on controlling money supply for stability. Monetarists prefer a more cautious dovish stance, keeping an eye on inflation risks. They foresee gradual policy tweaks in 2025, not big cuts.

Keynesians might advocate for long periods of near-zero rates to ensure full employment. But monetarists caution that too much easing could lead to inflation, harming long-term growth.

Notable Economists’ Forecasts Comparison

Several leading economists’ monetary policy views are shaping the 2025 outlook. Nobel laureate Paul Krugman believes structural challenges will require extended dovish policies. He predicts rates will stay below 3% through 2025.

Former Fed economist Claudia Sahm suggests a more balanced approach. She expects rates to stabilize around 3.5% by mid-2025, balancing inflation and growth. Meanwhile, Kenneth Rogoff fears too much dovishness could lead to asset bubbles, despite short-term gains.

- Mohamed El-Erian predicts a “new normal” of slightly higher neutral rates than pre-pandemic levels

- Stephanie Kelton emphasizes fiscal policy’s role in supporting dovish monetary approaches

- Raghuram Rajan cautions against ignoring international spillover effects of prolonged dovish policies

These varied academic economic forecasts for 2025 show the complexity of monetary policy choices. They highlight the different paths central banks might take in the post-pandemic world.

Inflation Expectations for 2025

The inflation outlook for 2025 is key for central banks’ policies. After a post-pandemic surge, forecasters see a stable price environment ahead. But, the journey to stability is uncertain, with many factors influencing price growth.

Economic models predict inflation will slowly move toward central bank targets. The speed and consistency of this decline will shape policy decisions. Knowing these projections helps investors and policymakers prepare for different economic scenarios.

Core Inflation Projections

Core inflation, excluding food and energy, gives a clearer view of price pressures. For 2025, consensus core inflation forecasts are between 2.1% and 2.4% in the United States. This suggests the Federal Reserve’s 2% target is near.

Several factors support this moderation in core inflation. Supply chain issues have largely been fixed, and labor market pressures have eased. Also, productivity gains from technology are expected to help offset wage growth.

However, services inflation is stubborn, with housing and healthcare costs rising. Wage growth, while slowing, is still around 3.5% annually. This creates a floor for services inflation, making it hard for core measures to return to pre-pandemic levels in 2025.

Consumer Price Index Forecasts

The Consumer Price Index (CPI) measures price changes for goods and services. CPI predictions for 2025 show headline inflation between 2.2% and 2.7% in the United States. This is slightly above core measures due to energy and food price volatility.

Energy prices are a big unknown in these forecasts. Geopolitical tensions and climate policies could raise energy costs. On the other hand, renewable energy advancements might lower them. Food prices are expected to grow at a slower pace as agricultural supply chains stabilize.

The table below compares CPI predictions from major financial institutions:

| Institution | 2025 CPI Forecast | Core Inflation Forecast | Key Factors Cited |

|---|---|---|---|

| Federal Reserve | 2.3% | 2.1% | Normalized supply chains, moderate wage growth |

| Goldman Sachs | 2.5% | 2.3% | Persistent services inflation, housing costs |

| IMF | 2.4% | 2.2% | Balanced labor markets, productivity gains |

| Morgan Stanley | 2.7% | 2.4% | Energy transition costs, continued wage pressures |

Regional Inflation Variations

Significant regional inflation differences are expected to continue through 2025. The Eurozone is forecast to have lower inflation rates (1.8-2.1%) than the United States. The United Kingdom might see slightly higher figures (2.5-2.8%).

Emerging markets show a mixed picture, with Latin America facing higher inflation (3.5-4.5%) than developed Asian economies like South Korea and Japan (1.5-2.0%). These differences reflect various factors such as labor markets, energy dependencies, and monetary policy cycles.

Sector-Specific Inflation Predictions

Looking at sector-specific inflation predictions, healthcare and education are expected to see above-average price growth (3.5-4.5%) through 2025. Technology and consumer electronics should continue their trend of price deflation (-1.0% to -2.0%), helping to offset increases elsewhere.

Housing-related inflation will vary by region, with urban centers showing moderation after rapid growth. Transportation costs are expected to stabilize as electric vehicle adoption increases and fuel efficiency improves. These sectoral differences will create both challenges and opportunities for investors positioning for a dovish policy environment.

Employment Market Predictions

The 2025 labor market is full of surprises. Dovish policies try to adjust to the post-pandemic world. Central banks are moving to easier money, but jobs might not follow the usual path. It’s key for investors, policymakers, and business leaders to understand this shift.

Unemployment Rate Forecasts

Experts have different views on unemployment forecasts for 2025. Most think jobs will get a bit better, but not by much. The U.S. is expected to keep unemployment between 3.8% and 4.2%, showing a stable job scene despite tech changes.

In Europe, things are more mixed. Northern countries might see rates under 5%, but southern ones could face rates over 7%. Aging populations in rich countries will also affect job numbers.

Automation is a big unknown. It could raise unemployment in some fields, but new jobs will also pop up. How fast this happens will decide if unemployment goes up or down in 2025.

| Region | 2025 Unemployment Forecast | Key Influencing Factors | Policy Sensitivity |

|---|---|---|---|

| United States | 3.8-4.2% | Tech sector growth, manufacturing reshoring | Moderate |

| European Union | 5.7-6.3% | Demographic shifts, green transition | High |

| Japan | 2.4-2.8% | Aging population, automation | Low |

| Emerging Markets | 6.5-8.2% | Youth population growth, informal economy | Very High |

Wage Growth Expectations

Wage growth projections for 2025 show small increases in most rich countries. Rates will likely be between 2.5% and 3.8% a year. This is a return to normal after the big jumps in the early 2020s.

Wages will still vary a lot based on skills. Tech, healthcare, and special manufacturing jobs will see big increases. But retail, hospitality, and admin jobs might just keep up with inflation.

How wages and productivity relate will be important. If wages grow too fast and productivity doesn’t, inflation could become a big problem. This would make it hard for policymakers to keep jobs and prices stable.

Jobs and wages will vary a lot by region. Places with diverse economies and good schools might see better wage growth. But areas relying on one industry could face more ups and downs. These differences will affect spending and housing markets in 2025 and later.

Housing Market Outlook Under Dovish Policies

Housing markets are at a turning point as central banks move to more supportive policies by 2025. The link between interest rates and real estate is strong. Lower rates boost demand and prices. As dovish policies grow, buyers and investors must grasp how these changes will affect housing in various areas.

Mortgage Rate Predictions

The dovish shift in 2025 is expected to lower mortgage costs significantly.Experts predict 30-year fixed mortgage rates will drop between 0.75% and 1.5% from 2024 levels. This drop will bring rates closer to their historical norms after the sharp hikes in 2022-2023.

Different mortgage types will react differently to policy changes. ARMs will quickly adjust to central bank moves, while fixed-rate mortgages will take 2-3 months. The gap between Treasury yields and mortgage rates could narrow to 1.4-1.5% as lenders compete in a better lending climate.

Markets that saw big affordability drops during high rates will likely see strong mortgage application increases. First-time buyers, especially millennials who delayed buying during high rates, may find 2025 a better time to enter the market.

Home Price and Affordability Forecasts

The dovish policy environment will lead to varied home price responses across markets. Lower rates increase buying power, with each 0.5% rate drop adding about 5% to buying capacity. This could spark demand in markets that cooled during high rates.

However, supply issues will continue to affect housing markets. Many areas still have low housing starts compared to population growth. This could limit the full benefits of lower rates in high-demand spots.

Price-to-income ratios are expected to improve slightly from 2023-2024 peaks but will still be high. Monthly payments will see bigger improvements as lower rates reduce borrowing costs.

| Dovish Scenario | Mortgage Rate Projection | Home Price Impact | Affordability Change | Regional Variation |

|---|---|---|---|---|

| Mild (0.5-0.75% cuts) | 5.0-5.25% (30-yr fixed) | 3-5% annual appreciation | Modest improvement | Strongest in mid-tier markets |

| Moderate (1.0-1.25% cuts) | 4.5-4.75% (30-yr fixed) | 5-7% annual appreciation | Significant improvement | Broad-based recovery |

| Aggressive (1.5%+ cuts) | 3.75-4.25% (30-yr fixed) | 7-10% annual appreciation | Substantial improvement | Risk of overheating in supply-constrained areas |

Home price forecasts for 2025 hint at a return to stronger growth after the 2023-2024 slowdown. Yet, this growth might not fully offset the affordability gains from lower rates, especially in areas with tight supplies. Policymakers must balance supportive monetary policies with efforts to boost housing supply for lasting affordability gains.

Stock Market Implications

Dovish policies in 2025 could change how we invest and which sectors do well. Central banks easing money conditions affects the stock market in different ways. This means both chances and risks for investors. Knowing how these changes work can help investors plan for the future.

Sectors Likely to Benefit from Dovish Policies

Some sectors do better when money is easier to get. Tech companies often grow as rates go down. This is because lower rates make future earnings more valuable today.

Consumer discretionary stocks also do well. When borrowing costs fall, people spend more. This helps companies in retail, travel, and leisure.

Real estate and homebuilders also benefit. Lower mortgage rates boost housing demand. REITs and dividend payments become more appealing to investors.

Financial services might see mixed results. Banks might face lower margins, but asset managers could see more activity.

Growth vs. Value Stocks

Growth stocks usually do better with dovish policies. Lower rates make future earnings more valuable. This is why tech and consumer innovation companies often lead during these times.

But, 2025 might be different. The starting valuations and the length of the last tightening cycle could change things.

Dividend Stocks Outlook

Dividend stocks have a unique role in 2025. They offer income, but their appeal might decrease with lower rates. This could lower demand.

However, companies with strong dividend growth might do well. They attract investors with both income and the economic boost from dovish policies.

Potential Market Volatility Factors

Even with dovish policies, several factors could lead to market volatility in 2025:

- Inflation surprises – If inflation is higher than expected, markets might worry about policy changes

- Policy disappointment – If central banks don’t ease policy as expected, markets could correct

- Valuation concerns – High valuations in some sectors could lead to big drops if growth doesn’t meet expectations

- Geopolitical developments – Issues like trade tensions or conflicts could overshadow monetary policy benefits

The mix of these factors and dovish policies could lead to a market with shifting sectors and styles. Investors should be ready for fast changes in market leadership as 2025 progresses.

Bond Market Projections

Dovish monetary policies will change the bond market a lot in 2025. They will bring both chances and challenges for investors. As central banks become more lenient, bond prices and yields will likely move a lot. It’s key to understand these changes for good portfolio planning next year.

Treasury Yield Curve Predictions

The treasury yield curve in 2025 will see big changes with dovish policies. Most experts think the curve will steepen. This means short-term rates will fall faster than long-term rates as the Federal Reserve cuts rates.

Two-year Treasury yields might drop to 2.0-2.5% by mid-2025. The 10-year yield could settle between 3.0-3.5%. This steepening shows the market’s hope for economic growth with easier money.

But, some economists fear a bull flattening scenario if growth stays slow despite rate cuts. If this happens, long-term yields could fall sharply. This would signal ongoing economic weakness, even with more money printing. The yield curve’s shape will be a key economic sign, with an inverted curve warning of recession risks.

Corporate Bond Market Outlook

The corporate bond outlook for 2025 looks good in a dovish environment. Lower rates usually make corporate bond prices go up. Also, better economic conditions from monetary stimulus can improve credit and lower default risks.

Corporate bond spreads are expected to narrow as investors look for better yields than government bonds. This narrowing will likely be most noticeable at the start of the dovish cycle. It could be a good time for corporate bond investors.

New bond issues are expected to rise in 2025 as companies take advantage of lower costs. This increase in supply might put pressure on prices. But, strong demand from investors looking for yields will help keep prices stable in the fixed income dovish environment.

Investment Grade vs. High Yield Comparison

In a dovish landscape, high-yield bonds might do better at first as optimism grows. The chance for spread narrowing is higher in high-yield markets, where risk premiums are higher.

But, investment-grade bonds are safer if growth is slower than expected. A good strategy is to have a mix of quality investment-grade bonds and some high-yield bonds in sectors ready for a cyclical upturn.

Duration Strategies

Choosing the right duration is key in the 2025 bond market forecast. As rates fall, longer bonds usually do better, gaining more from declining yields.

A laddered approach with more duration as the cycle goes on might work well. It’s smart to keep some shorter bonds for reinvestment and to guard against inflation surprises that could upset the dovish story.

Being active in managing duration will likely beat a static approach in 2025. Market volatility will offer chances across the yield curve. Keeping an eye on Federal Reserve talks is crucial for making the right duration moves.

Global Economic Factors Influencing Dovish Trends

The path of dovish monetary policies in 2025 will be influenced by international factors and central bank interactions. The global financial system is more connected than ever. This means policy changes in one area can affect others worldwide. Central bank coordination is key as they tackle challenges like recovery, supply chain changes, and global tensions.

Global trade, tech, and demographic changes are shaping the world’s economy. These factors will push central banks towards more supportive policies. They aim for growth over fighting inflation in the next years.

European Central Bank vs. Federal Reserve Policies

The European Central Bank (ECB) and the Federal Reserve have different goals. The Fed focuses on keeping prices stable and jobs high. The ECB aims to keep prices stable across the eurozone’s diverse economies.

By 2025, the ECB and the Fed might take different paths. The Fed might use targeted rate cuts to help certain sectors. The ECB will face the challenge of keeping unity among its member states with different economies.

Currency values will also be important. If the Fed is more dovish than the ECB, the dollar might fall against the euro. This could push the ECB to be more supportive to keep exports competitive.

Emerging Markets Central Banks’ Approaches

Emerging market central banks have unique challenges. They must balance growth with keeping their currencies stable. This is harder as money flows change due to interest rate differences.

Countries like China, India, and Brazil will likely set their own monetary policies. But, they might face limits due to major central banks’ actions. Capital flow management will be key for these economies in the dovish global environment.

| Central Bank | Primary Concerns | Expected 2025 Approach | Policy Constraints |

|---|---|---|---|

| Federal Reserve | Growth sustainability | Moderately dovish | Inflation resurgence risk |

| European Central Bank | Regional disparities | Cautiously dovish | Member state disagreements |

| People’s Bank of China | Domestic stability | Selectively accommodative | Currency depreciation concerns |

| Reserve Bank of India | Inflation management | Gradually dovish | Food price volatility |

Emerging economies with strong fundamentals can set their own monetary policies. Those with more foreign reserves and less debt can adopt dovish policies safely.

Comparison of Dovish vs. Hawkish Scenarios for 2025

Looking at dovish and hawkish policies shows big differences for 2025’s economy and markets. Central banks can choose to focus on growth (dovish) or control inflation (hawkish). Knowing these differences helps investors plan their portfolios.

A detailed policy scenario analysis shows dovish and hawkish policies affect the economy and markets differently. Let’s see how these paths might play out.

Economic Growth Differentials

The economic growth scenarios for 2025 vary with dovish and hawkish policies. Dovish policies, with lower interest rates, can boost GDP by 0.5-1.5 percentage points. This is due to several economic factors.

With dovish policies, people spend more because borrowing is cheaper. This boosts consumer spending. Businesses also invest more, upgrading technology and expanding, which increases productivity.

| Economic Indicator | Dovish Scenario | Hawkish Scenario | Differential Impact |

|---|---|---|---|

| GDP Growth | 2.8-3.5% | 1.5-2.3% | +0.5-1.5% |

| Unemployment | 3.2-3.8% | 4.0-4.8% | -0.8-1.0% |

| Business Investment | 5.5-7.0% growth | 2.0-3.5% growth | +2.5-4.5% |

| Consumer Spending | 3.0-4.2% growth | 1.8-2.5% growth | +1.2-1.7% |

Dovish policies often lead to stronger labor markets and lower unemployment. The 2025 dovish vs hawkish comparison shows dovish scenarios could have unemployment rates 0.8-1.0 percentage points lower. This means more jobs and higher wages.

However, hawkish policies have their own benefits. They help keep prices stable and prevent asset bubbles. Tighter money policies ensure sustainable growth by avoiding economic overheating and reducing correction risks.

Market Performance Variations

Financial markets react differently to dovish and hawkish policies, offering unique opportunities and risks. The market performance forecast for 2025 under these scenarios is crucial for investors.

Equity Market Comparison

Equity markets usually do better under dovish policies. Growth stocks and cyclical sectors lead. Lower interest rates increase valuations, and better economic activity boosts earnings. Key winners include:

- Technology – Benefits from lower discount rates for future earnings

- Consumer discretionary – Gains from increased household spending

- Real estate – Advantages from lower financing costs

On the other hand, hawkish policies favor value stocks, defensive sectors, and companies with strong pricing power and low debt.

Fixed Income Market Comparison

Bond markets show clear differences between dovish and hawkish scenarios. In dovish environments, declining or stable interest rates can lead to capital appreciation for bondholders, especially in longer-term bonds. The yield curve steepens as short-term rates fall and long-term rates reflect better growth expectations.

In hawkish conditions, shorter-duration bonds and floating-rate instruments tend to perform better. Credit spreads widen as economic growth concerns rise, making high-quality bonds more attractive than high-yield debt.

Investors should watch key signs to see which scenario is happening:

- Central bank communication tone and forward guidance

- Inflation data trends, especially core services

- Labor market tightness indicators

- Yield curve movements

- Credit spread dynamics

By tracking these indicators, investors can adjust their strategies as the policy environment becomes clearer in 2025.

Investment Strategies for a Dovish 2025 Environment

The 2025 dovish monetary policy opens up new investment chances. Central banks might lower interest rates and use easier policies. Investors need to adjust their strategies to these changes.

Knowing how to adapt to these shifts can increase returns. It also helps manage the risks that come with easier money policies.

Asset Allocation Recommendations

In a dovish setting, traditional asset allocation models might need tweaking. Fixed income investments could see benefits from lower interest rates. Longer-term bonds might look more appealing as prices go up when yields drop.

Consider putting 25-35% of your portfolio in high-quality bonds with different maturities. This mix can balance income and growth potential.

Equities often do well when money is easier to get. Growth stocks, in particular, benefit from lower interest rates on future earnings. Aim for 40-60% of your portfolio in equities, focusing on quality companies with strong cash flows.

Don’t overlook international investments. Dovish U.S. policies can weaken the dollar, making foreign investments more attractive.

Alternative investments are also worth considering. Real estate investment trusts (REITs) and gold can thrive in a dovish environment. A 10-20% allocation to these can diversify your portfolio.

Remember, your risk tolerance is key. Conservative investors might lean more toward bonds and less toward equities. Growth-oriented investors could focus on cyclical equities and emerging markets.

Sector Rotation Strategies

Effectivesector rotationis vital in a dovish setting. Different industries react differently to easier money. Consumer discretionary, technology, and financial sectors often do well early on.

These sectors see more spending, lower borrowing costs, and wider profit margins. As dovish policies continue, consider shifting to real estate, utilities, and consumer staples. These sectors offer more stable returns and can act as a defense if growth slows.

Timing these shifts is crucial. Watch key economic signs. Early-cycle chances come when central banks first hint at policy changes. Mid-cycle, focus on sectors that keep growing. Late-cycle, look for quality and defensive plays.

Take a gradual approach to sector rotation. Avoid big portfolio changes. Instead, make small adjustments as data shows policy effects. This balanced strategy can capture sector-specific gains while managing risks.

Stay flexible, as actual dovish policy paths may vary. Regular portfolio checks and adjustments based on economic changes are crucial for success in 2025.

Potential Risks to Dovish Predictions

Investors need to watch out for risks that could change dovish monetary policy plans for 2025. Central banks face changing economic conditions that can force them to adjust their plans. Knowing these dovish policy risks helps investors plan for different scenarios and stay flexible.

Inflation Resurgence Scenarios

An unexpected rise in inflation is a big threat to dovish predictions. Several factors could lead to this inflation resurgence threat, making central banks keep rates higher than planned.

Supply chain issues are still a worry. Even though global logistics have improved, new problems could happen. Also, sudden price hikes in commodities, especially energy, could lead to higher prices everywhere.

Wage-price spirals are another risk. With tight labor markets, wages could keep rising, pushing inflation up. Changes in how goods are made and traded could also raise costs.

Even a small rise in inflation could change rate cut plans. Central banks might be more careful, cutting rates less than expected.

Political and Policy Uncertainties

The political scene adds a lot of monetary policy uncertainties that could affect dovish policies. Elections in big countries in 2024-2025 might lead to new leaders with different economic views.

New leaders at central banks could bring fresh ideas or face more pressure to boost growth. These political factors central banks must deal with can greatly shape policy decisions.

Law changes could also change how central banks work. Ideas to change their mandates or how they’re run often come up during economic changes. This could limit their ability to adjust policies.

Global events add more uncertainty. Conflicts, trade issues, or sanctions can cause supply problems or upset financial markets. Central banks might have to wait to ease policies because of these issues.

So, investors should see monetary policy forecasts as likely but not guaranteed. Creating plans that can adjust to different scenarios will be key as the economy changes in 2025.

Conclusion

The dovish monetary policy outlook for 2025 marks a big change in how central banks work. This shift from strict to more flexible policies will bring both chances and hurdles for investors.

Looking ahead, the economy is expected to slowly ease up, with inflation staying steady and jobs remaining strong. Central banks will have to walk a fine line to support growth without letting inflation rise too high.

Investors need to rethink their usual plans in this new environment. Bonds might look more attractive as interest rates could peak. Some stocks, especially those affected by interest rates, might do well. Real estate could also see better times as mortgage rates drop.

But, there are risks ahead. Things like global conflicts, supply chain issues, and sudden inflation increases could upset the dovish plan. Investors will need to stay flexible and keep an eye on the economy.

By grasping these central bank trends and getting ready, investors can tackle this changing time in global money policy. The expected dovish move in 2025 doesn’t mean an easy ride. Yet, it offers a guide for those ready to adjust their investment tactics to new situations.